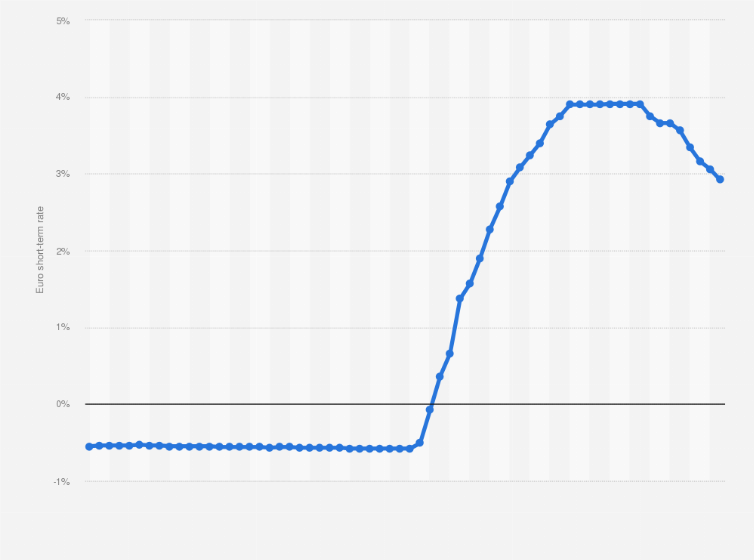

Charlie Bilello on Twitter: "Eurozone inflation has moved up to 7.5%, its highest level ever. Meanwhile, the ECB is still holding interest rates at negative levels with no plans to normalize. This

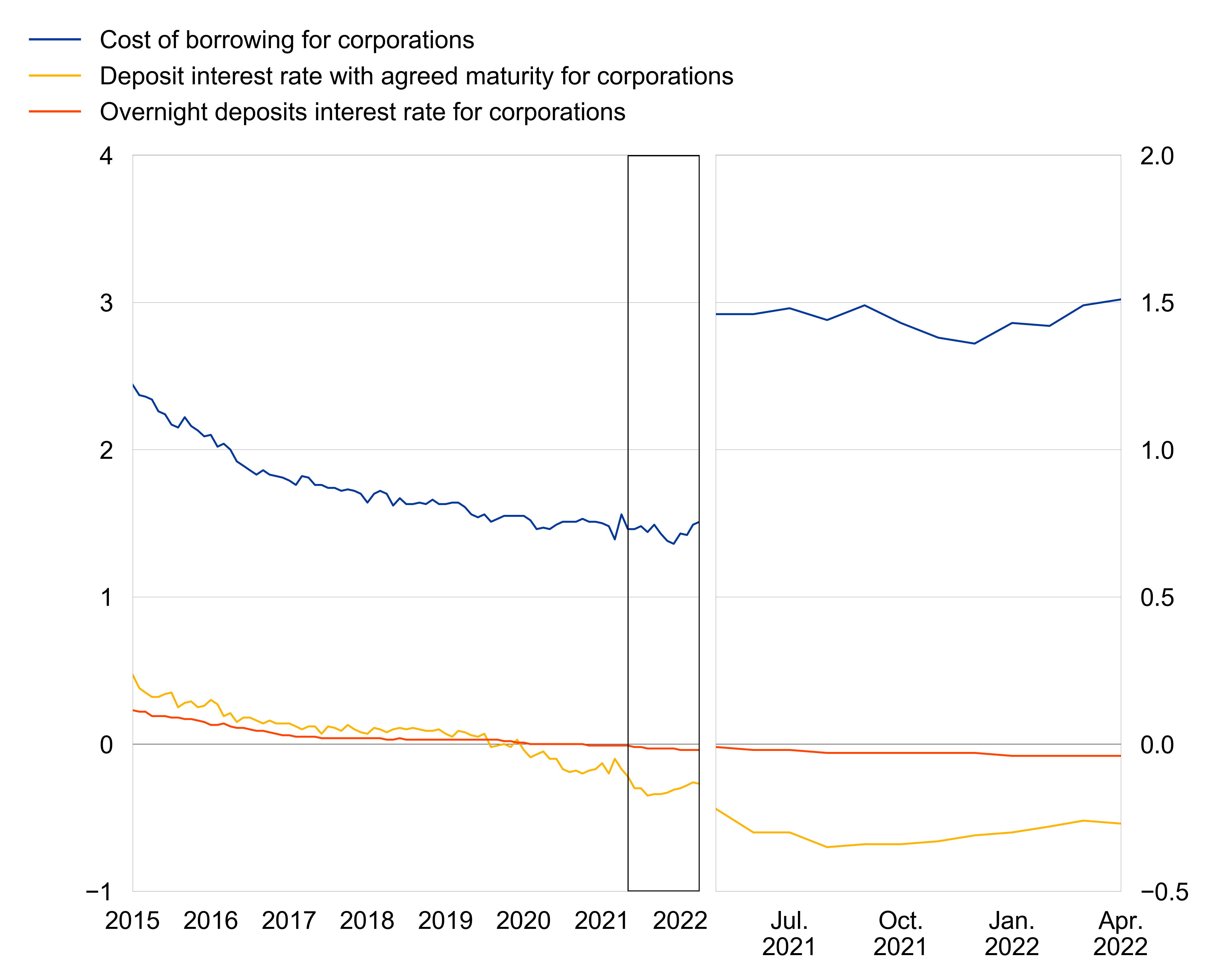

Prospects for euro area bank lending margins in an extended low-for-longer interest rate environment

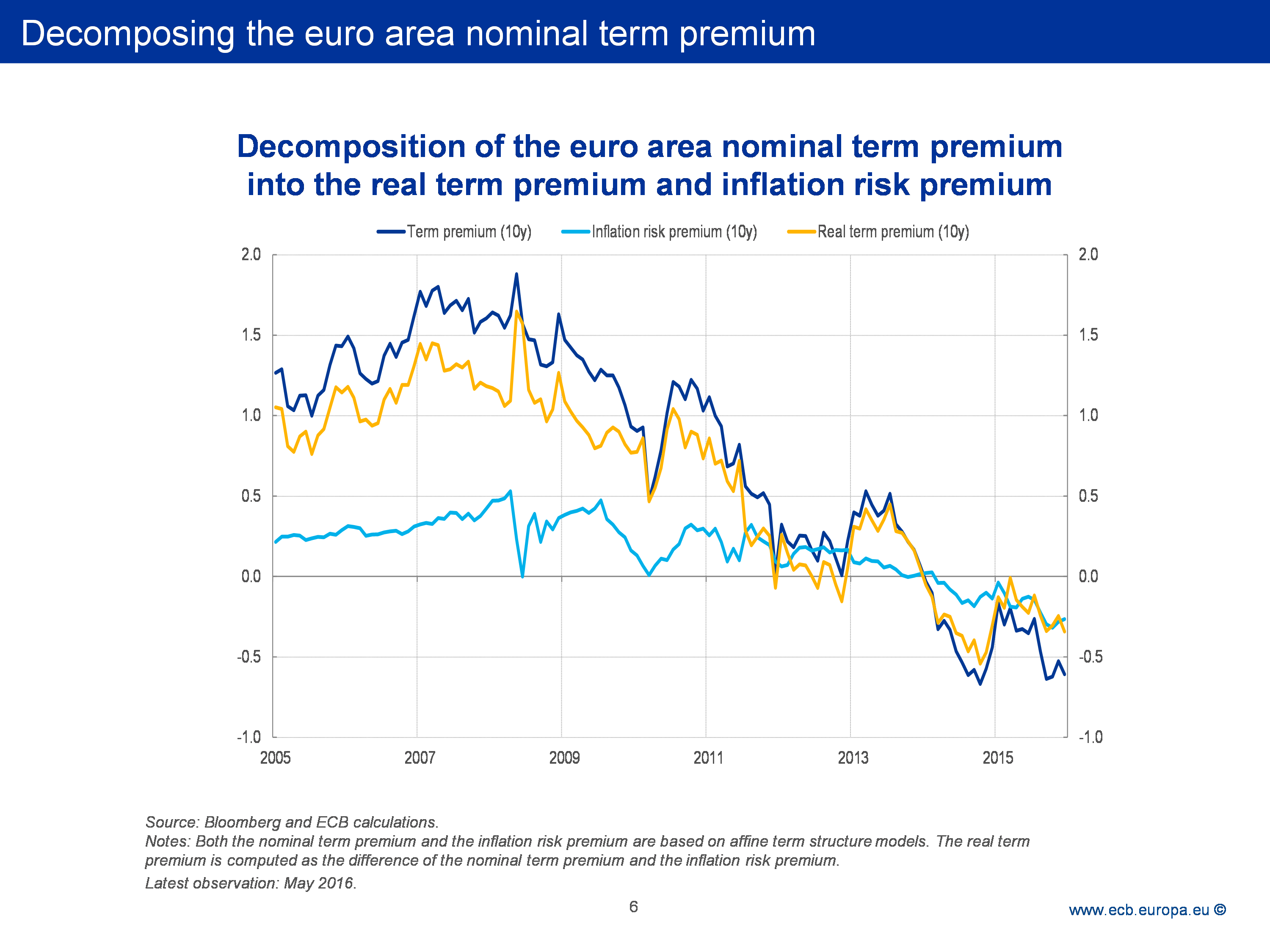

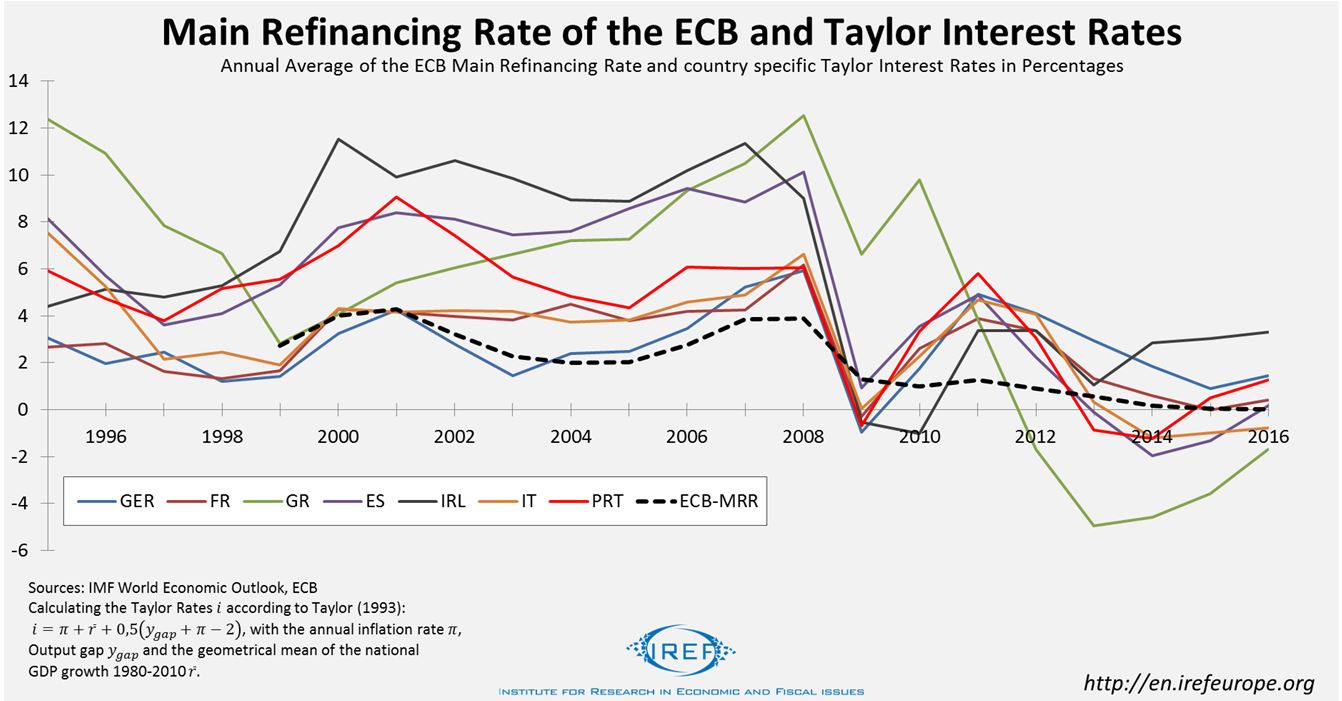

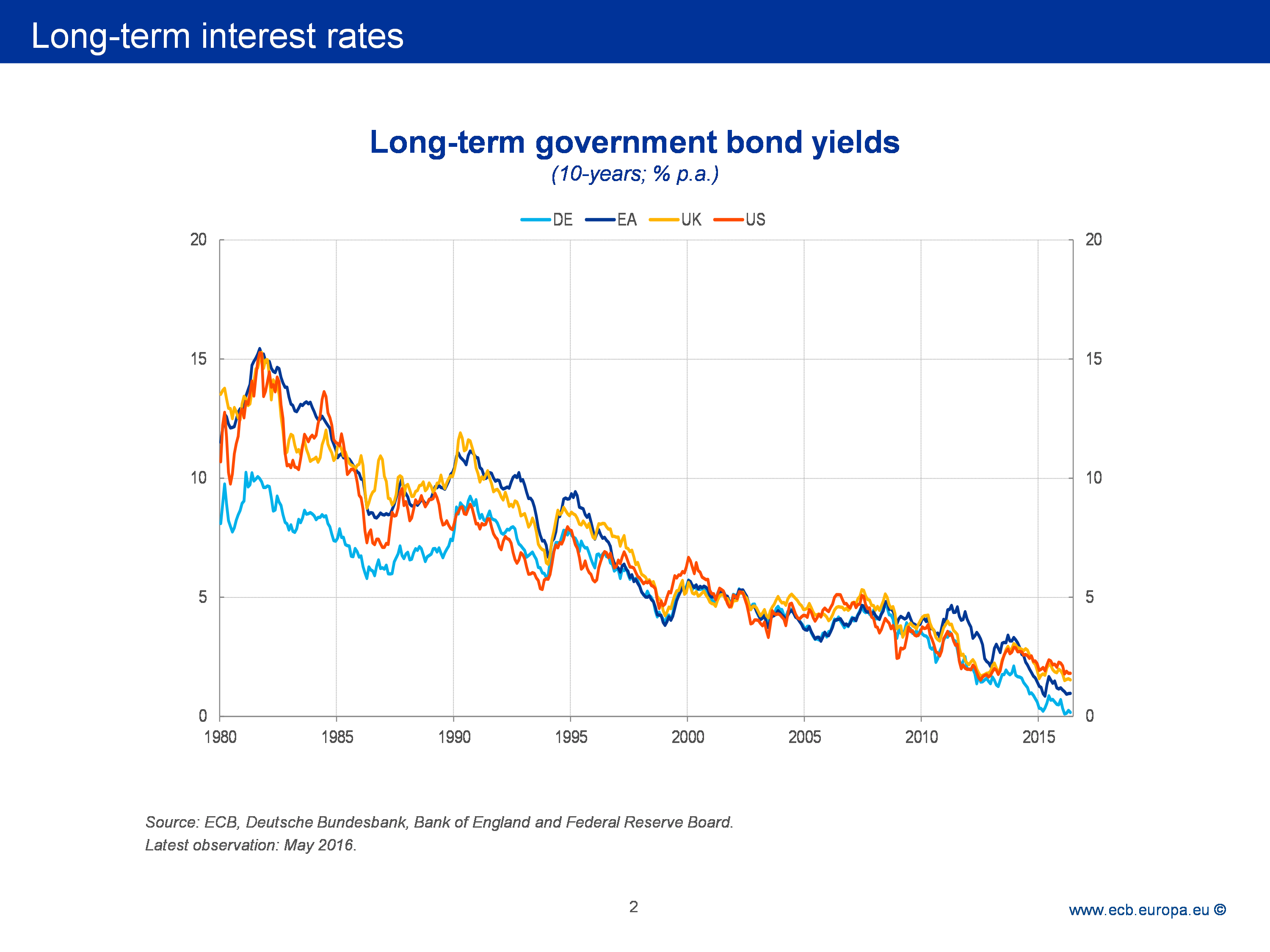

Changes in the short-term interest rate and the expected 10-year government bond yield are primarily explained by economic shocks other than the ECB's monetary policy surprises – Bank of Finland Bulletin

Charlie Bilello on Twitter: "Eurozone inflation has moved up to 8.6%, its highest level ever. Meanwhile, the ECB is still holding interest rates at negative levels. This is perhaps the greatest disconnect